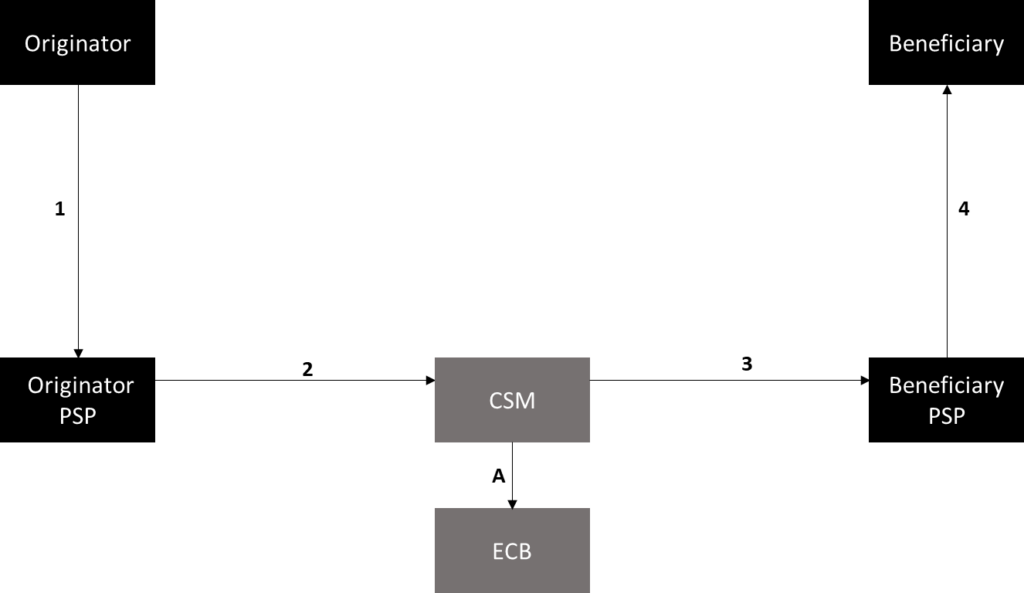

This model describes a simple, commonly used, model for SEPA Credit Transfer (SCT) and assumes the use of a single “Clearing and Settlement Mechanism”.

- The Debtor (Originator in EPC terms) creates an instruction to transfer an amount in Euros to from his bank account in the SEPA area to the bank account in the SEPA area of the beneficiary. The standard message format is pain.001, but the instruction can also be entered directly in the banking application.

- The Originator PSP (Debtor Bank) validates the instruction and checks if there are sufficient funds to execute the transaction. If all checks are okay, the instruction converted into an interbank instruction (pacs.008) and is forwarded to the Clearing and Settlement Mechanism.

- The CSM validates the instruction, and if valid:

- (A) Creates the settlement instruction to transfer the funds from the Originator PSP to the Beneficiary PSP via the accounts both hold at the European Central Bank.

- Forwards the original instruction to the Beneficiary PSP

- The Beneficiary PSP informs the Beneficiary that the account is credited.

Timelines

Regular SCT

For regular SEPA Credit Transfer the legal times is that the Beneficiary receives the funds in his account the next working day latest. Often timelines are much faster.

SEPA Instant Credit Transfer

For regular SEPA Instant Credit Transfer the Beneficiary receives the funds in his account 10 seconds after the Originator PSP created the instruction.

Complexer models

More complex models can include the use of “Payment Initiation Service Provider (PISP)”, Intermediary PSP, split of the CSM function in Clearing activities and Settlement performed by different actors. Since the timelines are governed by EU legislation and EPC Rulebooks, the complexity of the process will not increase the mentioned timelines.