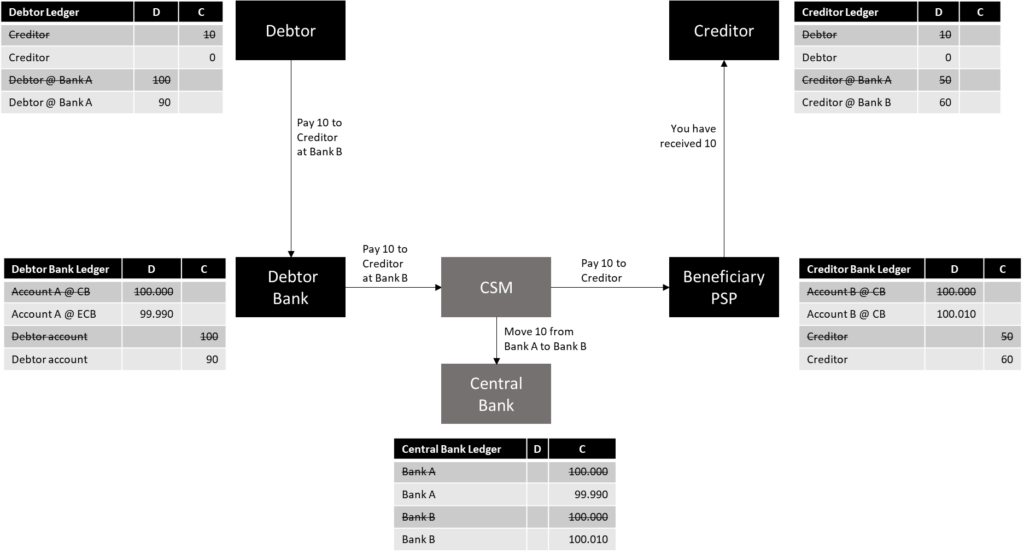

The model below describes a the impact on the different ledgers when money is transfered from a Debtor to a Creditor.

The model below describes a the impact on the different ledgers when money is transfered from a Debtor to a Creditor.

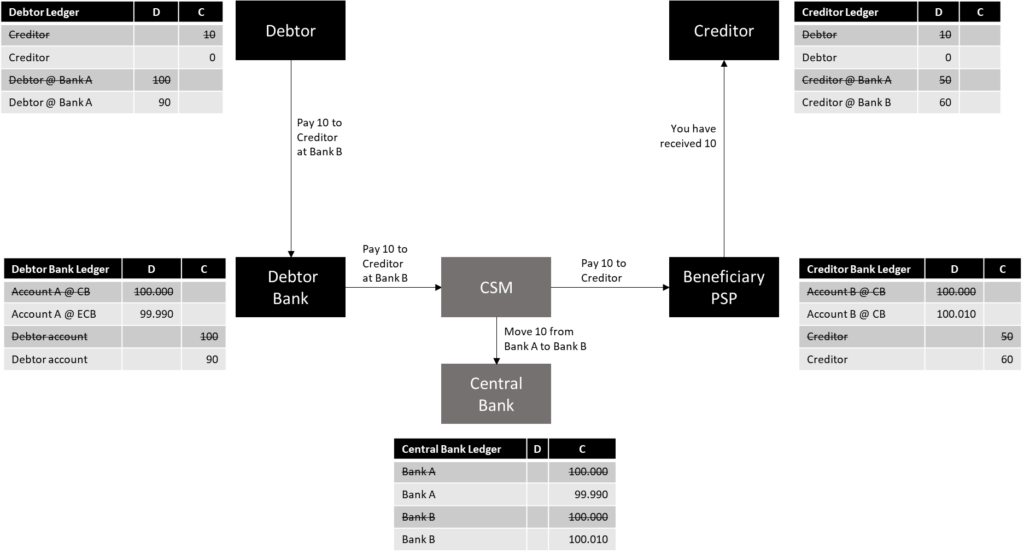

This model describes a simple, commonly used, model for SEPA Credit Transfer (SCT) and assumes the use of a single “Clearing and Settlement Mechanism”.

Timelines

Regular SCT

For regular SEPA Credit Transfer the legal times is that the Beneficiary receives the funds in his account the next working day latest. Often timelines are much faster.

SEPA Instant Credit Transfer

For regular SEPA Instant Credit Transfer the Beneficiary receives the funds in his account 10 seconds after the Originator PSP created the instruction.

Complexer models

More complex models can include the use of “Payment Initiation Service Provider (PISP)”, Intermediary PSP, split of the CSM function in Clearing activities and Settlement performed by different actors. Since the timelines are governed by EU legislation and EPC Rulebooks, the complexity of the process will not increase the mentioned timelines.

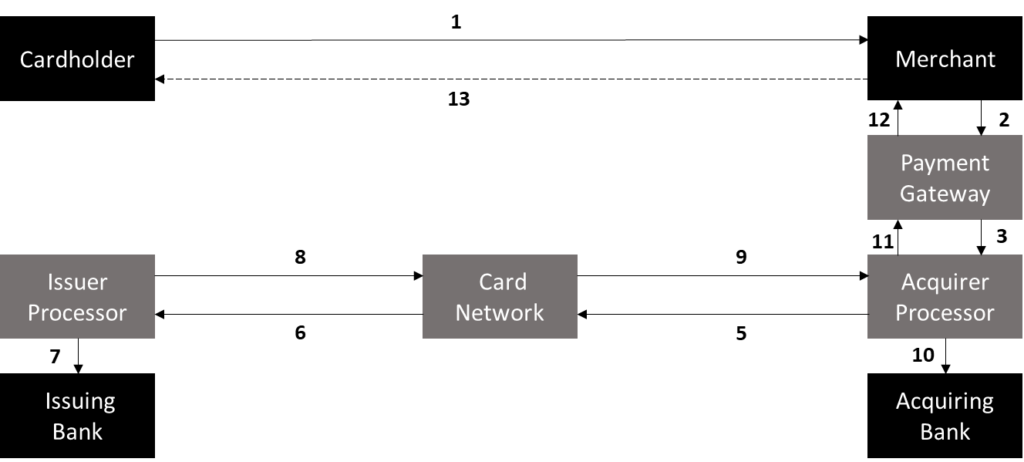

The model below describes a standard process for Credit Card payments in an online scenario. The process assumes that Capture of the payment happens immediatly after Authorization.

Process steps

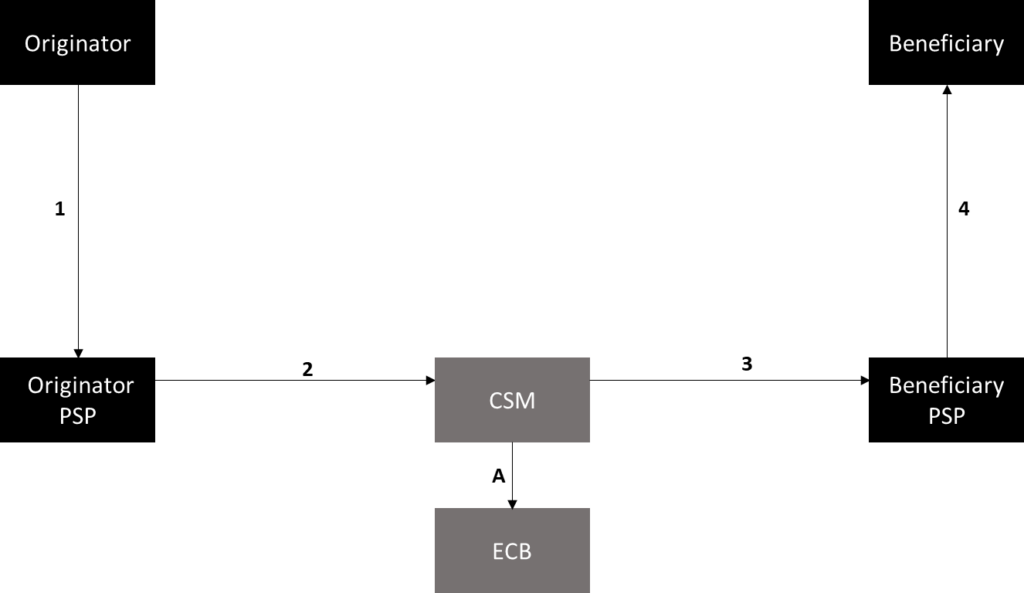

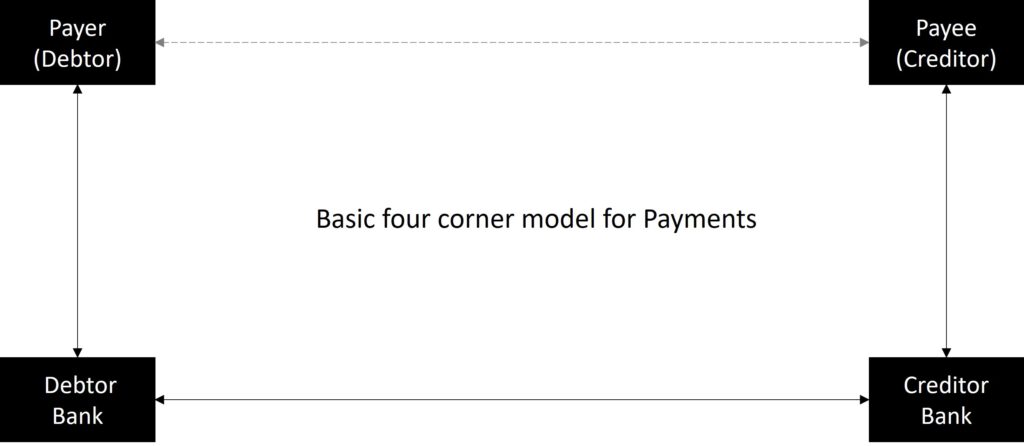

The Four Corner Model is the basic model for understanding payment processing. The essence of payments processing is a Payer wanting to transfer funds from its account at his bank to the account of the Payee held at the same or another bank.

The basic process is that the Payer instructs his bank in some shape or form to take funds out his is bank account an put it in the account of the Payee. The Debtor Bank than transfers the funds to the Creditor bank after which the Creditor Bank credits the account of the Payee.

This model is the basic form used to explain payment processes, for different payment processes additional players can appear.

Terminology

The payment industry uses a lot of terms to identify the same object or sometimes uses the same terms but with a slightly different meaning. The terminology used can be specific for a certain domain.

For example, in Card processing the Payer is often referred to as “Cardholder” or “Consumer” where in ACH payments the Payer is often referred to as “Debtor”. Similar in Card Payments the Payee is mostly referred to as “Merchant” and the Creditor Bank as “Acquiring Bank”.